Open your first investing account & get a $50 deposit bonus.

Fund $500 or more to a taxable automated investing account with Wealthfront and we’ll give you an extra $50 — exclusive to NerdWallet readers. Start investing for the long-term with globally diversified portfolios or look for a higher yield than a traditional savings account with an automated bond portfolio.

The views and opinions expressed by NerdWallet (“Affiliate”) are their own, and Wealthfront does not endorse, sponsor, or promote them.

The referring Affiliate receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for sponsored advertising materials placed on their website or other contents, which creates an incentive that results in a material conflict of interest. The Affiliate is not a client and this is a paid endorsement. The referring Affiliate and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Disclosures continued.

The $50 Promotion (“Promotion”) is solely available to the select individuals who do not have an existing Investment Account or Cash Account, who click on ‘Get Started’ and subsequently open and fund their first taxable Investment Account at Wealthfront Advisers LLC ("Wealthfront") with at least $500 within 30 days. Clients who open a tax-advantaged or 529 Investment Account will not be eligible for this promotion. In order to be eligible for the Promotion, you must pass Wealthfront’s identity verification process, deposit at least $500 in your first Wealthfront taxable Investment Account, and maintain the funds in that account for at least 7 days. After meeting the terms of the Promotion, Wealthfront will deposit $50 into your first taxable Investment Account at Wealthfront within 30 days. Wealthfront reserves the right to change the terms set forth herein or terminate the Promotion at any time without notice. Wealthfront reserves the right to decline to provide or to clawback the $50 Promotion in the event that Wealthfront determines, in its sole discretion, that there may have been a violation of the terms of the Promotion or that any fraudulent activity occurred in connection with the Promotion. Additional Promotional Terms.

1.3M+

$90B+

4.8

4.9

1

Best Robo-advisor, Portfolio Options, 2024

Best Robo-advisor, IRA, 2022

1

1

2

2

Trusted clients

In assets managed

Best Robo-advisor, 2022

Best Robo-advisor, 2020

Best Investing app, 2024

Apple App Store

Google Play Store

1

1

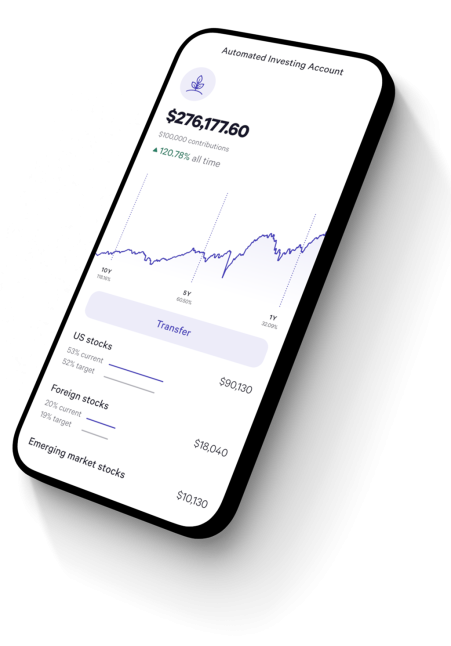

AUTOMATED INVESTING ACCOUNT

Invest for the long term with automated, expert-built

portfolios.

Come bears or bulls, our Automated Investing Account helps you stay diversified for your goals. Designed to help manage your risk, minimize your taxes, and maximize your potential returns — all with built-in, automated easy-ness.

Personalized with up to 17 global asset classes

Automated reinvestment and rebalancing

Tax-Loss Harvesting can help boost after-tax returns

Designed to keep the cost of investing low

AUTOMATED BOND PORTFOLIO

Earn bond yields

the automatic way.

4.12%

Blended 30-day SEC yield,

after advisory fee as of 02/10/2026*

Total returns since inception

(03/30/23): 16.98%

Get the benefits of bond ETFs (like the potential to earn a higher yield than a traditional savings account and tax advantages) without the balancing act of managing locked-in rates or maturity dates — or the headache of researching and buying individual bonds.

Designed to help minimize risk and maximize yield

Personalized for optimal tax savings

Withdraw any time with no penalties

No lock-up periods or maturity dates

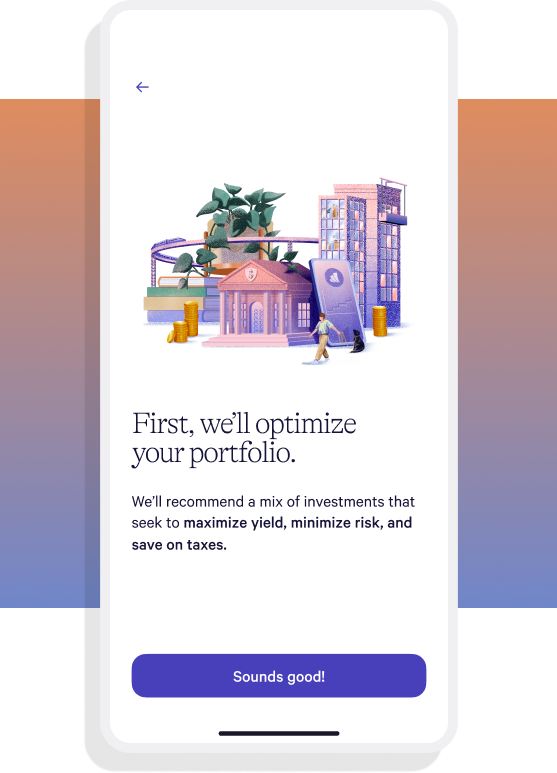

No time to invest? No problem.

Get started in minutes.

An automated approach to investing means using academically-proven techniques designed to continually optimize your portfolio and help save money on taxes — without any manual trades or market-watching. Take just a few minutes to set your investing preferences, then let our software keep your money on track over the long run.

Wealthfront takes the crown for best overall platform on the market.

The single best resource for investing, managing retirement and seeing my entire financial picture.

I LOVE Wealthfront and have moved almost all of my finances there.

Daniel C., Automated Bond Portfolio

Joshua B., Automated Investing Account

Investopedia, 2022

Investopedia is not a client and this is a paid endorsement. They receive cash compensation for advertising Wealthfront, which is a conflict of interest. The testimonials provided from Wealthfront clients may not be representative of the experience of others, and there is no guarantee that all clients will have similar experiences.

Back to top

1 .Nerdwallet and Investopedia (the “Endorsers”) receive cash compensation for referring potential clients to Wealthfront Advisers, LLC (“Wealthfront Advisers”) via advertisements placed on their respective websites. The Endorsers and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Nerdwallet’s opinions are their own. Their ratings are determined by their editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Nerdwallet ranking as of June 2023. Wealthfront provides cash compensation in connection with obtaining this ranking. Investopedia designed a system that rates robo-advisors based on nine key categories and 49 variables. Each category covers the critical elements users need to thoroughly evaluate a robo-advisor. Learn more about their methodology and review process. Investopedia ranking as of January 2023. Wealthfront provided cash compensation in connection with obtaining this ranking. © 2017-2023 and TM, NerdWallet, Inc. All Rights Reserved.

2. Apple App Store and Google Play Store ratings are based on user ratings that are subject to change and submitted according to the applicable terms of use maintained by the Apple App Store and the Google Play Store. The Apple App Store and the Google Play Store do not utilize questionnaires or surveys and are not designed or prepared to produce any predetermined result. Users may submit ratings and verbatim feedback based on their experience with the Wealthfront application, which rating and or verbatim feedback may or may not reflect that user’s experience with the investment advisory product or service provided by Wealthfront Advisers. Reported ratings are as of July 7, 2024, and based on all user ratings submitted from February 2014 (Apple) and December 2015 (Google) through July 2024. Ratings independently compiled by Apple, Inc., and Google, Inc., who receive compensation for hosting our app but not for collecting or compiling reported ratings.

References to “Total Client Assets” and "Clients" include clients with assets in products offered by both Wealthfront Advisers and Wealthfront Brokerage. Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers, Wealthfront Brokerage or any affiliate endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

All UI screenshots provided are for illustrative purposes only.

Investors should carefully assess the risks associated with bond ETF investments. Bond ETF performance may not precisely mirror the underlying index due to tracking errors from factors like bond weighting differences, transaction costs, and timing. Management fees can affect overall returns. Bond ETFs expose investors to risks, including interest rate risk, potentially leading to capital losses as rising rates decrease underlying bond values. Most bond ETFs lack a fixed maturity date or guaranteed principal repayment at maturity. Bond ETFs may generate capital gains from portfolio rebalancing, potentially resulting in unexpected tax liabilities.

Credit risk is a concern, as bond issuers’ financial health can impact ETF value. Some bond ETFs may use derivatives, introducing counterparty risk where losses can occur if a counterparty fails to fulfill its contractual obligations. Call risk should also be considered, as falling interest rates might prompt callable bond issuers to repay securities before maturity, forcing reinvestment in lower-yield or riskier securities.

The Automated Bond Portfolio is covered by SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org. It does not provide protection against losses resulting from market fluctuations.

Bond ETFs are less liquid than cash, potentially affecting buying and selling shares at desired prices. Some may prefer the stability and accessibility of savings or deposit accounts despite lower yields.

Equities may offer higher long-term gains than bonds or cash investments, providing capital appreciation and reinvestable dividend income. However, equities present increased risk due to market fluctuations and short-term price volatility. Investors with longer time horizons and higher risk tolerance may allocate a portion of their portfolios to equities, acknowledging the possibility of gains and losses. Investors should weigh these risks before investing. Past performance does not guarantee future results.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short-term or long-term).

Wealthfront Advisers’ investment strategies, including portfolio rebalancing and tax-loss harvesting, can lead to high levels of trading. High levels of trading could result in (a) bid-ask spread expense; (b) trade executions that may occur at prices beyond the bid ask spread (if quantity demanded exceeds quantity available at the bid or ask); (c) trading that may adversely move prices, such that subsequent transactions occur at worse prices; (d) trading that may disqualify some dividends from qualified dividend treatment; (e) unfulfilled orders or portfolio drift, in the event that markets are disorderly or trading halts altogether; and (f) unforeseen trading errors. The performance of the new securities purchased through the tax-loss harvesting service may be better or worse than the performance of the securities that are sold for tax-loss harvesting purposes.

Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Investment management and advisory services-which are not FDIC insured- are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage related products, including the cash account, are provided by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/ SIPC.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2025 Wealthfront Corporation. All rights reserved.