WELCOME TIM FERRISS LISTENERS

Investing

is easy when it’s automated.

Tim Ferriss listeners get $5K managed for free when they open an Investment Account through the button below.

The referenced Podcast receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for sponsored advertising materials, which creates an incentive that results in a material conflict of interest. The Podcast host is not a client and this is a paid endorsement. Tim Ferriss holds a non-controlling equity interest in the corporate parent of Wealthfront Advisers. Otherwise, the referenced Podcast and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided by this Podcast are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. Investment management and advisory services are provided by Wealthfront, an SEC registered investment adviser. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance.

1

1

700K+

$50B+

2

2

4.8

4.9

Best Robo-advisor, Portfolio Options, 2022

Best Robo-advisor, IRA, 2022

Best Robo-advisor, 2020

Best Robo-advisor, 2022

Trusted clients

In assets managed

Apple App Store

Google Play Store

Start investing in just a few minutes.

Sign up.

1

We’ll ask a few questions to understand what kind of investor you are.

Make a deposit.

2

Get started with just $500. We’ll put your money into a diverse mix of investments.

Start growing your savings.

3

Our automation does the rest. We’ll make the trades and do the investing work for you.

Clean Energy and US Stocks ESG are shown for illustrative purposes only. Not intended as a recommendation to buy or hold.

Build a portfolio you believe in

We offer hundreds of funds across dozens of categories, including social responsibility, clean energy, tech, and crypto to let you customize your portfolio with investments you’re excited about. And we make it easy — and safe — to experiment by letting you know if your choices aren’t in line with your preferred risk level.

ETFs are shown for illustrative purposes only and are not intended as a recommendation to buy or hold.

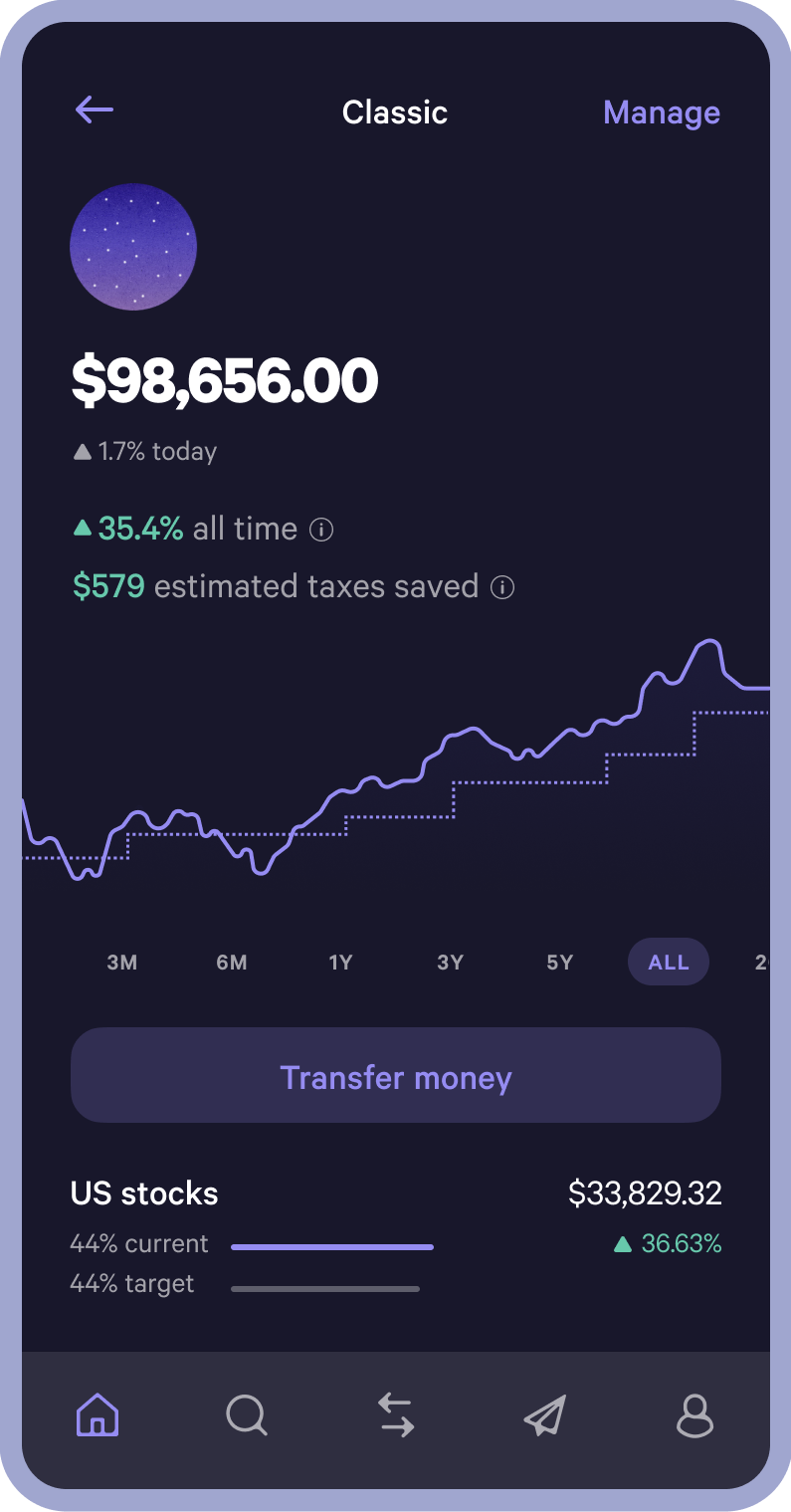

Investing so wonderful,

it finds something good in taxes.

Not only do we charge no account and no trading fees, our Tax-Loss Harvesting can reduce the taxes you pay. In fact, the savings for most clients in recommended portfolios cover our 0.25% advisory fee more than 4.7 times.

No investing experience? No problem.

We keep it simple.

We do the busywork.

We help minimize risk.

Set up your account in just a few minutes and easily track your returns through the Wealthfront app.

We invest your money in a diversified portfolio across different sectors to minimize your exposure to risk of dips in the market.

Our automation manages the trading so your portfolio is always up to date and earning you as much it can.

Back to top

1 Nerdwallet and Investopedia (the “Endorsers”) receive cash compensation for referring potential clients to Wealthfront Advisers, LLC (“Wealthfront Advisers”) via advertisements placed on their respective websites. The Endorsers and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Nerdwallet’s opinions are their own. Their ratings are determined by their editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Nerdwallet ranking as of January 2022. Wealthfront provides cash compensation in connection with obtaining this ranking. Investopedia designed a system that rates robo-advisors based on nine key categories and 49 variables. Each category covers the critical elements users need to thoroughly evaluate a robo-advisor. Learn more about their methodology and review process. Investopedia ranking as of January 2022. Wealthfront provided cash compensation in connection with obtaining this ranking. © 2017-2022 and TM, NerdWallet, Inc. All Rights Reserved.

2 Apple App Store ratings based on user ratings from February 2014 through June 2021. Ratings compiled by Apple, Inc., who receive compensation for hosting our app.

Investors may experience different results from the hypothetical returns shown in the visuals above. No representation is being made that any client account will or is likely to achieve performance returns or losses similar to those shown herein. Hypothetical expected returns are presented for illustrative purposes only. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in achieving the returns have been stated or fully considered. Changes in the assumptions may have a material impact on the hypothetical returns presented. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) changes in laws and regulations and (4) changes in the policies of governments and/or regulatory authorities.

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Wealthfront Advisers relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Wealthfront Advisers or its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

The Tax-Loss Harvesting yield is the average after-tax benefit, net of fees, expressed as a multiple of our annual fee. This calculation is based on the last five full calendar years for clients with a risk score of 8 for clients using the Classic Recommended portfolios and assuming capital losses up to $3,000 with a tax rate of 25%.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Investment management and advisory services--which are not FDIC insured--are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2023 Wealthfront Corporation. All rights reserved.